The registration fee for CA Final exam 2021 is Rs. 22,000 which a student needs to pay online mode. Students who wished to appear for the Nov 2021 session should have completed the CA Final registration 2021 by May 2021 Details provided in the application form will be mentioned on the CA Final admit card 2021. For more details regarding the CA Final application form 2021, read the full article. If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

Last Date for CA Final Registration Form

Recommended Articles

CA Final Registration Form

Students must ensure that they check the CA Final eligibility criteria prior to filling the registration form. Only those who qualified CA IPCC/ Intermediate and completed the requisite practical training will be able to fill the registration of CA Final 2021. After CA Final 2021 registration is completed, Students can fill the application form and ICAI will send the CA final study material to the Students. The CA Final registration fee can be paid in online mode only. Registration can be applied for by submitting the CA Final Registration Form along with the prescribed fee and the supporting documents

Download: CA Final-Registration Form

CA Final Registration Fees

Students will be required to pay INR 22,000 for the full CA Final course.

Documents Required For CA Final Registration

The Student shall also submit the following documents at the time of submission of the Registration Form:

A recent, passport-sized, coloured photographCA IPCC/ Intermediate marksheet attested by a CACopy of IT Training CertificateCopy of Orientation Program Training CertificateCopy of IPCC Mark sheet attested by a Chartered Accountant

A Student can apply for CA Final Registration at any time before submitting the CA Final Exam Form. It usually takes ICAI a few months to process the CA Final Registration Form and therefore we recommend students to apply for CA Final Registration minimum 3 months before submitting the CA Final Exam Form

CA Final 2021 Eligibility Criteria

must have qualified CA Intermediate/ PE-II examination. must have registered for CA Final 2020 and obtained the Final Course registration number from the Board of Studies (BoS). must have completed the required practical training as a member or is serving the last twelve months of practical training on the first day of the month in which the CA Final exam is to be held.

How to Register For CA Final 2021? – Step by Step Guide

students can follow the steps given below to fill the registration form for CA Final 2021:

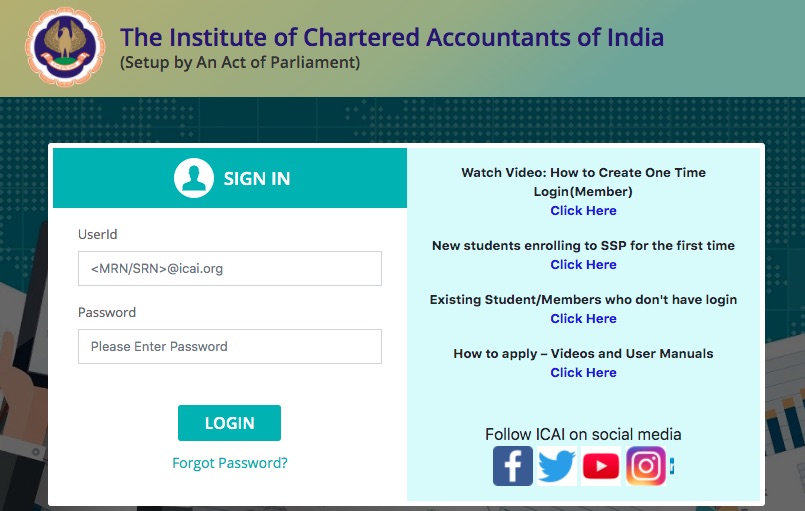

Click on the link provided above to register with BoS for CA Final 2021. Click on the ‘New User Registration’ link. A new window will appear prompting the students to select on a suitable form. Choose the ‘Existing student (already applied for any course with ICAI) »click here« to register with this portal’.Enter your registration number provided by ICAI and date of birth, and click on ‘Validate’.Another page will open up with incomplete details of the student. students will be required to complete the form with correct details.

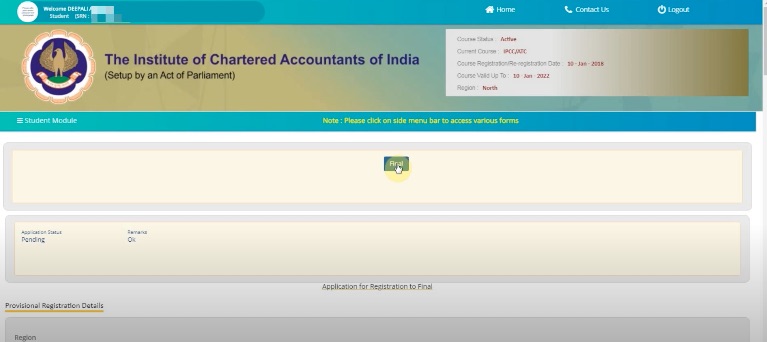

An OTP will be sent to the student’s registered phone number and email ID. Enter the OTP and click on ‘Submit’. Click on ‘Please click here to log in with the registered email id and password’. After logging in, a new form will be available wherein students must enter their necessary details and upload the mandatory documents. Click on ‘Save’.In the next window, click on ‘Apply’ in the ‘Final’ row as shown below

The CA Final application form will be available for filling.

CA Final Syllabus

Group I Paper 1: Financial Reporting (100 Marks) Paper 2: Strategic Financial Management (100 Marks) Paper 3: Advanced Auditing and Professional Ethics (100 Marks) Paper 4: Corporate and Allied Laws (100 Marks)

Section A: Company Law (70 Marks)Section B: Allied Laws (30 Marks)

Group II Paper 5: Advanced Management Accounting (100 Marks) Paper 6: Information Systems Control and Audit (100 Marks) Paper 7: Direct Tax Laws (100 Marks) Paper 8: Indirect Tax Laws (100 Marks)

Section A: Central Excise (25 Marks)Section B: Service Tax (50 Marks)Section C: Customs & Foreign Trade Policy (25 Marks)

Recommended Articles

IPCC RegistrationCA Foundation Registration