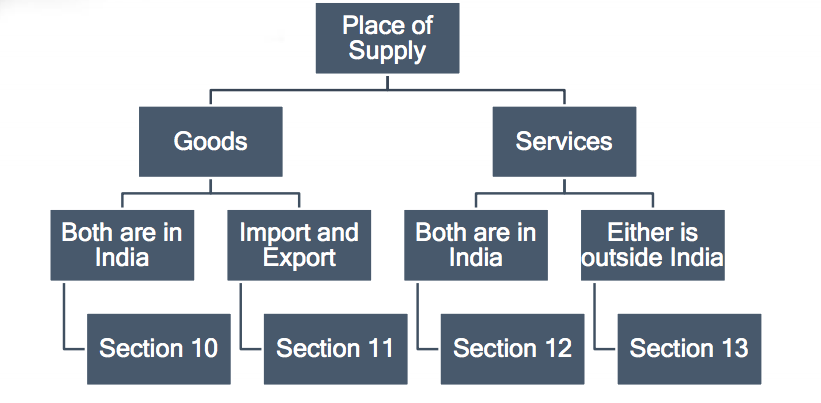

Place of supply of goods and services under GST regime:-

Place of Supply of goods where no export / import

Important points

Before you determine Place of supply, please decide classification Location of Supplier is very important to decide Decide who is recipient of service Be clear of the Section your Services fall in Place of supply is not equal to place of performance Territorial waters – Location of Supplier or Place of supply (Section 9) Determination of Place of Supply of goods is different from that of Services Section 2(15) – Location of Supplier of Services

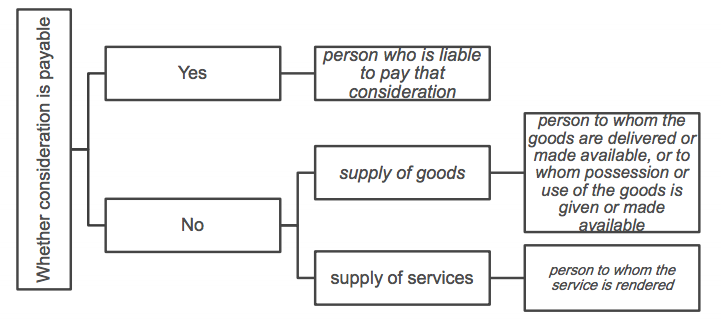

Section 2(93) CGST- Recipient of Supply

Deemed Inter state Supply

Supply of services imported into the territory of India Supply of goods or services or both when the supplier is located in India and the place of supply is outside India. Supply of goods or services or both to or by a Special Economic Zone developer or a Special Economic Zone unit Supply of goods or services or both when in the taxable territory, not being an intra-State supply and not covered elsewhere, shall be treated to be a supply of goods or services or both in the course of interState trade or commerce

Need for Place of Supply

For whom are these rules meant? These rules are primarily meant for:

persons who deal in cross-border services Persons dealing in interstate transactions Suppliers operating within India from multiple locations and supplying goods /services from different locations Special transaction zones like SEZ, exempted zones etc To enable determination of place of levy and jurisdiction To ensure no double taxation by different states on same transaction To ensure proper tax collection by different states and enabling them to get their proper share To ensure proper Rules for Goods and Services separatel Ensure seamless credit

IGST – Levy

IGST on supply of good supply of goods in the course of inter-State trade or commerce means any supply where:

the location of the supplier and the place of supply are in different States

Deemed Inter State Supply

A supply of goods and/or services in the course of import An export of goods and/or services

Exceptions to this Rule given in Section 5

Online information and database access or retrieval services

means services whose delivery is mediated by information technology over the internet or an electronic network and the nature of which renders their supply essentially automated and involving minimal human intervention and impossible to ensure in the absence of information technology and includes electronic services such as,—

advertising on the internet; providing cloud services; provision of e-books, movie, music, software and other intangibles through telecommunication networks or internet; providing data or information, retrievable or otherwise, to any person in electronic form through a computer network online supplies of digital content (movies, television shows, music and the like); digital data storage; and online gaming;

Location of recipient in case of OIDAR

the location of address presented by the recipient of services through internet is in the taxable territory; the credit card or debit card or store value card or charge card or smart card or any other card by which the recipient of services settles payment has been issued in the taxable territory; the billing address of the recipient of services is in the taxable territory; the internet protocol address of the device used by the recipient of services is in the taxable territory; the bank of the recipient of services in which the account used for payment is maintained is in the taxable territory; the country code of the subscriber identity module card used by the recipient of services is of taxable territory; the location of the fixed land line through which the service is received by the recipient is in the taxable territory. Place of Supply CA Ga

Place of Supply of Services

Place of Supply of Services – General (where Location of Supplier and Recipient is in India)– Section 12 Place of Supply of Services – General (where Location of Supplier and Recipient is in India)– Section 12 Section 2(14) “location of the recipient of services” means,––

where a supply is received at a place of business for which the registration has been obtained, the location of such place of business; where a supply is received at a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment; where a supply is received at more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the receipt of the supply; and in absence of such places, the location of the usual place of residence of the recipient;

Section 2 (85) CGST: “place of business” includes––

(a) a place from where the business is ordinarily carried on, and includes a warehouse, a godown or any other place where a taxable person stores his goods, supplies or receives goods or services or both; or (b) a place where a taxable person maintains his books of account; or (c)a place where a taxable person is engaged in business through an agent, by whatever name called;

Section 2 (50)CGST / (7) IGST: “fixed establishment” means a place (other than the registered place of business) which is characterised by a sufficient degree of permanence and suitable structure in terms of human and technical resources to supply services or to receive and use services for its own needs; Section 2 (113) CGST: “usual place of residence” means––

(a) in case of an individual, the place where he ordinarily resides; (b) in other cases, the place where the person is incorporated or otherwise legally constituted;

Section 2(15) “location of the supplier of services” means,––

where a supply is made from a place of business for which the registration has been obtained, the location of such place of business; where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment; where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provision of the supply; and in absence of such places, the location of the usual place of residence of the supplier;

Illustrative Case Study

ABC is a big CA firm of Vadodara; receives assignment from Client HO at Chennai for physical verification of fixed assets at various plants located throughout the country, as also its Guest House at Delhi & Mumbai, and its Administrative Office at Ahmedabad. What would be the Place of Supply for the professional services for which the invoice is to be raised to HO? ABC is a CA firm of Mumbai having offices at Bangalore, Kolkata, Delhi & Chennai; receives an assignment from Client HO at Mumbai for multi-disciplinary professional services to be provided at multiple locations of the client. The Mumbai office involves specialist staff from its other offices. How to determine the nature and place of supply of services? A CA firm at Vadodara is appointed by BOB(Vadodara office) for stock audit at the factory of the bank’s customer located at Thane. What would be the place of supply?

Recipient deemed be in taxable territory

Two of the following conditions need to be satisfied:

Location of the address presented by recipient of service via internet is in taxable territory Debit/credit/any other card for settlement of payment has been issued in the taxable territory Billing Address of recipient of service is in the taxable territory IP address of the device used by the recipient is in the taxable territory Bank of recipient in which the account used for payment is maintained in the taxable territory Country code of SIM card used by the recipient is of taxable territory Location of fixed landline through which service is received by the recipient is in taxable territory

Recommended Articles

Role of Company Secretary Role of CS in GST When will GST be applicable Filing of GST Returns Returns Under GST GST Registration GST Rates Role of CMAs in GST Role of Chartered Accountants HSN Code List GST Login GST Rules