Complete Details as Per Model GST Law, Reverse Charge Applicability as Per GST Model Law, Check all Rules for Reverse Charge under GST Law. Applicability of Reverse Charge as Per Revised Model GST Law in India. Meaning of Reverse Charge as per GST Law, Introduction of Reverse Charge as Per GST Law, GST Reverse charge mechanism. Later part of Section 8(3) talks about reverse charge applicability for specified categories of services, wherein the recipient of goods or services would be liable to for paying tax in relation to supply of goods and or services. Now scroll down below n check more details for “Reverse Charge under GST – Complete Details as Per Model GST Law” Important Update for GST Reverse Charge on 06-10-2017 or in Simple Words The reverse charge mechanism U/s 9 (4) of the CGST Act, 2017 & U/s 5 (4) of the IGST Act, 2017 suspended till 31.03.2018. Specific reverse charge u/s 9(3) shall continue. In India, the concept of reverse charge under GST is being introduced which is already present in service tax. Currently, there is reverse charge mechanism in supply of services only. But in GST RCM applicable for both services and goods.

Reverse Charge under GST Regime

Applicabilty:

All persons who are required to pay tax under reverse charge have to register for GST irrespective of the threshold Threshold:- turnover in a financial year exceeds Rs 20lakhs (Rs 10 lakhs for North eastern states). A person who is required to pay tax under reverse charge has to compulsorily register under GST and the threshold limit of Rs. 20 lakhs (Rs. 10 lakhs for special category states except J & K) is not applicable to him.

Reverse Charge Mechanism under GST with Example

- under reverse charge mechanism only the buyer is the responsible person to pay the GST tax because the registration was not taken from the department by the seller 2)Here the buyer should not claim any input tax credit on his purchase because he did not paid it but GST will be collected from him on his sale In reverse charge mechanism the buyer of the goods did not setoff any taxes from his output tax because he did not paid any tax on his purchase. The entire amount of output tax liability has to paid to the GST DEPARTMENT Example – Q) Ravi has purchased 10000 value of the goods from the dev and the GST rate is 10%(SUPPOSE). But the DEV was not registered with the GST department and ravi is selling these goods for 12000 Solution: ( under reverse charge mechanism)

Ravi did not paid any GST TAX that is 1000 (1000010%) but from his sale he will collect 1200 GST TAX( 1200010%)Ravi should not claim any input tax of( 1000)because he did not paid it but he has to pay total amount of 1200 to the GST department.

List of Services Under Reverse Charge as Approved by GST

Invoicing rules:

Every service recipient, who is paying tax on the basis of reverse charge has to mention fact in his GST invoice that is being issued. A registered person who is liable to pay tax under reverse charge i.e., the buyer has to mandatorily issue an invoice in respect of goods or services received by him from the supplier who is not registered. Important Articles & Files

List of All Services Exempted in GST RegimeGST Rate for Services 2017: List of all services Taxable in GSTDownload GST Rate Chart on Services & List of Services ExemptedClassification Scheme for Services under GST

What is the reverse Charge mechanism under GST

In a normal course of business , Supplier has to pay tax on the Supply of goods or Service Provider has to pay on the services rendered .But in the reverse charge, recipient of goods or services or both is liable to pay GST. In simple words, ‘Reverse Charge’ means the liability to pay tax is on the recipient of Goods or Services instead of the Supplier of goods or Service Provider. Reverse Charge appliesto both Goods as well as Services . According to Section 9(4)of CGST Act, 2017 or Sec 5(4) of IGST Act , 2017 : The tax in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both. Section 2 (98 ) of CGST Act 2017

the liability to pay tax by the recipient of supply of goods or services or bothinstead of the supplier of such goods or services

GST REGISTRATION UNDER RCM All persons who are required to pay tax under reverse charge have to register for GST irrespective of the threshold [Threshold:- turnover in a financial year exceeds Rs 20lakhs (Rs 10 lakhs for North eastern and hill states)]

Situations Where The Reverse Charge Will Apply

Unregistered dealer selling to a registered dealer (In such cases, the registered dealer is required to pay GST on RCM basis for such supply.) Services through an e-commerce operator CBEC has notified a list of 12 services on which GST paid by the recipient on 100% reverse charge basis: the Services are (Click here to Download)

Non-resident service providerGoods Transport AgenciesLegal service by an Advocate/ Firm of AdvocatesArbitral TribunalSponsorship ServicesSpecified Services provided by Government or Local Authority to Business entityServices of a director to a companyInsurance agentRecovery Agent of Bank/FI/ NBFCTransportation Services on ImportPermitting use of CopyrightRadio Taxi services to E-commerce aggregator (eg: Ola, Uber, etc.)

Time of Supply for Goods Under Reverse Charge

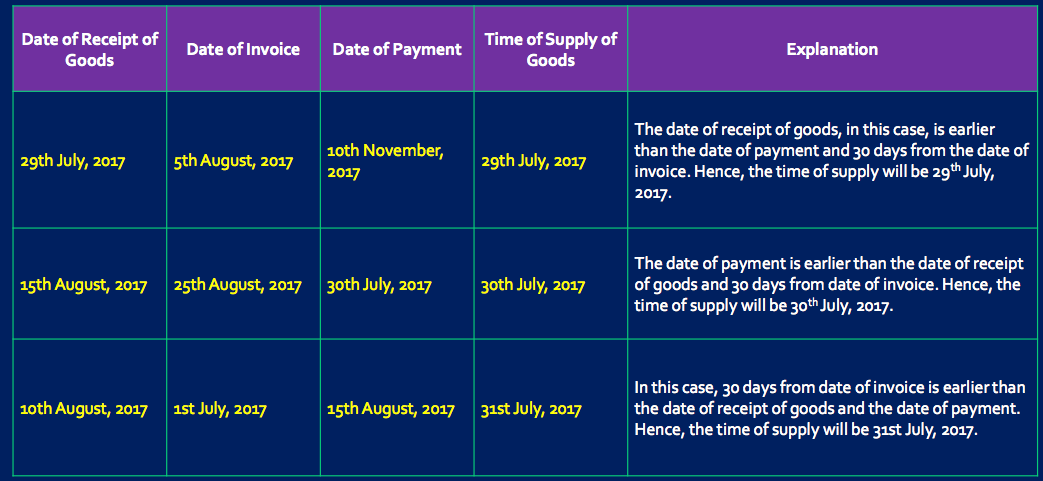

In case of reverse charge, the time of supply shall be the earliest of the following dates -:

(a) the date of receipt of goods OR(b) the date of payment OR(c) the date immediately after THIRTY days from the date of issue of invoice by the supplier (60 days for services)

If it is not possible to determine the time of supply under (a), (b) or (c), the time of supply shall be the date of entry in the books of account of the recipient Example: Time of supply of goods 15th May 2018 If for some reason time of supply could not be determined supply under (1), (2) or (3) then it would be 18th May 2018 i.e., date of entry

Time of supply for services under reverse charge

In case of reverse charge, the time of supply shall be the earliest of the following dates (a) The date of payment OR (b) The date immediately after SIXTY days from the date of issue of invoice by the supplier (30 days for goods) Example for reverse charge: If it is not possible to determine the time of supply under (a) or (b), the time of supply shall be the date of entry in the books of account of the receiver of service. When supplier is located outside India In case of ‘associated enterprises’, where the supplier of service is located outside India, the time of supply shall be the date of entry in the books of account of the receiver OR the date of payment whichever is earlier Example for reverse charge:

Date of payment 15th July 2018Date of invoice 1st July 2018Date of entry in books of receiver 18th July 2018

Time of supply of service 15th May 2018 If for some reason time of supply could not be determined supply under (a) or (b) then it would be 18th July 2018 i.e., date of entry in books.

list of services on which reverse charge is applicable

Input Tax Credit under RCM

A supplier cannot take ITC of GST paid on goods or services used to make supplies on which the recipient is liable to pay tax.

The service recipient can avail Input Tax credit on the Tax amount that is paid under reverse charge on goods and services.The only condition is that the goods and services are used or will be used for business or furtherance of business.Unfortunately, ITC cannot be used to pay output tax, which means that payment mode is only through cash under reverse charge.

List of Services Under Reverse Charge as Approved by GST Now check more details for “Reverse Charge under GST – Complete Details as Per Model GST Law” from below..

When will GST be applicableGST Definition, ObjectiveSupply of GoodsFiling of GST ReturnsReturns Under GST, ReturnsGST Current Tax StructureExpected Scheme of GSTGST RegistrationsGST Rates