Must Guide – How to Make GST Payment

How to Track GST Payment Status without Login at GST Portal

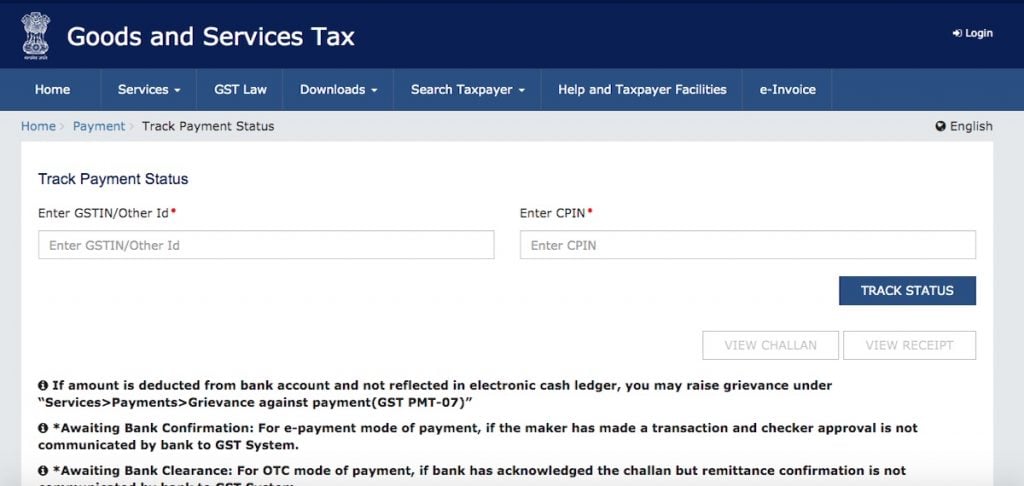

To track status of a GST payment without logging to the GST Portal, perform the following steps:

- Access the https://www.gst.gov.in/ URL. The GST Login Home page is displayed

- Click the Services> Payments > Track Payment Status command.

- In the Enter GSTIN field, enter your GSTIN.

- In the Enter CPIN field, enter your CPIN.

- In the Type the characters as displayed below field, enter the captcha text.

- Click the TRACK STATUS button. The payment status is displayed. To view the challan, click the VIEW CHALLAN button. Note:

If the status of Challan is FAILED / NOT PAID and mode selected is E-Payment, Taxpayer can click on the VIEW CHALLAN button, select the Bank, Terms and Conditions and click on the MAKE PAYMENT button to do the Payment again for the Failed or Not Paid challan.If Payment status is PAID, then the VIEW RECEIPT button is enabled and Taxpayer can view the receipt and also download the receipt after clicking on the VIEW RECEIPT button. In case of any other Status of challan (other than PAID), Taxpayer will be able to View the Challan.

How to Track GST Payment Status after Login at GST Portal

How can I track status of a GST payment after logging to the GST Portal?

You can view the status of a GST payment through Challan history. Challan history is available only after post-login to the GST Portal. To track status of a GST payment after logging to the GST Portal, perform the following steps:

- Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

- Login to the GST Portal with valid credentials.

- Click the Services > Payments > Challan History command.

- Select the date range in the From and To date fields using the calendar.

- Select the Search by CPIN in case you want to track the payment of the challan through the CPIN. In case you don’t know the CPIN number, you can select the Search By Date option to search the CPIN number by date on which it was generated.

- Click the I Will Search button.

- The list of Challans with the payment status within the selected date range is displayed. Note: By default, you latest 10 Challans are displayed in a chronological order.

- Click the CPIN (Common Portal Identification Number) link. The payment receipt or Challan is displayed. Note:

Payment receipt is displayed only for Challans with PAID status,You can also download the receipt by clicking the DOWNLOAD button.If the Expiry Date mentioned on the Challan is passed, the Challan becomes an Expired Challan. Any payment made using an expired Challan is not a valid payment. If a payment is made after the Challan’s expiry date and if the payment was accepted by the Bank, the payment status will not be updated at the GST Portal.

Taxpayers will be intimated regarding the payment status by SMS, E-mail and the same will also be updated on the GST Portal. In the pre-login mode, taxpayers can track their payments using the Track Payment Status facility on the GST portal under Services > Payments > Track Payment Status. In the post-login mode, taxpayers can access their Challan History under Services > Payments > Challan History.

2. What are different payment status types?

1. Initiated – If no intimation has been received from Bank (during the re-ping in case of E-payment)2. Paid – CIN received by taxpayer and status updated on portal as PAID3. Not Paid – default status on challan generation4. Failed – Failure of any online transaction initiated by taxpayer5. Paid at tax Office – When taxpayer makes payment at Commercial Tax Office counter (Enforcement Activity).6. Awaiting Bank Confirmation – In case of Internet Banking (Maker-Checker) till the time Checker authenticates the transaction7. Awaiting Bank Clearance – Instrument (cheque/DD) deposited in case of Over The Counter mode8. Expired – No payment initiated within 15 days of generation of challan9. Cheque/DD Dishonored – Instrument dishonored due to insufficient funds or any other reason10. Transaction Failed – On failure of transaction initiated through Internet Banking or Credit Card/Debit Card.11. MoE Reversal – Memorandum of Error not in favor of taxpayer

Recommended Articles

GST FormsInterest on late payment of GSTGST Due DatesGST RefundGST Payment FormatsHSN Code ListGST RatesGST Registration